Part-1:

Sub Menus

Customer accounting

- Customers

Customer Invoices

Customer refunds

About

Odoo Accounting section is the area where the user carries out the day to day accounting operations for the business.

Standards Followed

Double-entry bookkeeping.

Accrual and Cash Basis Methods.

Multi-companies.

Accounts Receivable & Payable.

We have a simple step wise guide that will help you to do Accounting entries like a pro.

This blog post will serve as a guide for any of the below accounting posting.

Create customers/suppliers

view and manage customer/supplier invoices

view and manage customer/supplier refunds

manage sales receipts and purchase receipts

manage customer/supplier payments

manage bank statements and cash registers

manage journal entries and items

manage chart of accounts and chart of taxes

manage re-curing entries and reconciliation

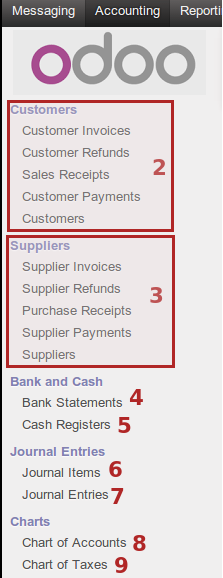

We documented how Odoo places various accounting menus for your convenience.

Sub menus

The following screen-shot shows the sub menu items in the accounting section :

1. Accounting area main menu

2. Customer accounting management

3. Supplier accounting management

4. Bank statements: Summary of all financial transactions occurring over a given period for each account

5. Cash register: Cash log to manage cash entries in cash journals, allowing business to track incoming and outgoing cash transactions

6. Journal items

7. Journal entries

8. Chart of accounts

9. Chart of taxes

10. Draft entries

11. Reconciliation

12. Recurring entries

13. End of period

14. Legal reports

15. Generic reporting

16. Configuration section of accounting area

Customer accounting

Odoo allows us to create and send professional invoices and record payments online. There is no need to send reminders to your debtors instead set automated follow-ups to get paid more quickly. Automatically create invoices from sales orders, delivery orders or base them on time and material. You can also Invoice expenses on projects to your customer.

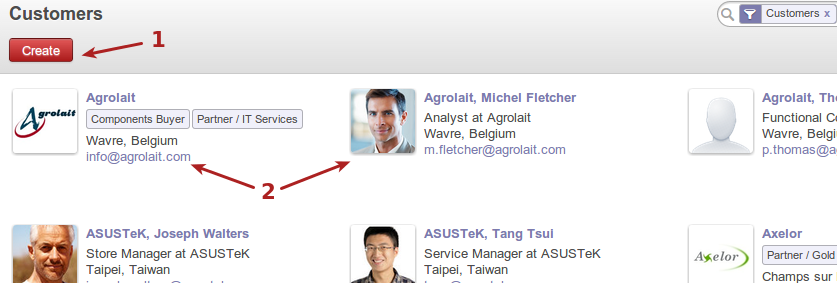

Customers

This section allows a user to search current customers or add a new customer to the system.

The following screen-shot displays the customer kanban view :

Create new customer button.

Current customer view with some info about customer.

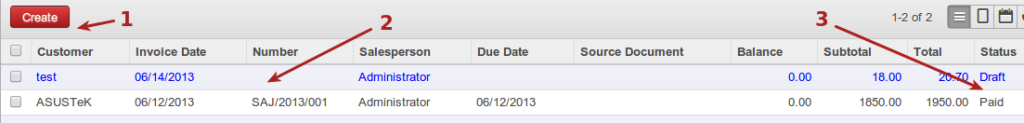

Customer invoices

The following screen-shot displays the list view for customer invoices :

Create new invoice by clicking on button.

Invoice list with various info about invoice.

Invoice status, draft, paid, etc.

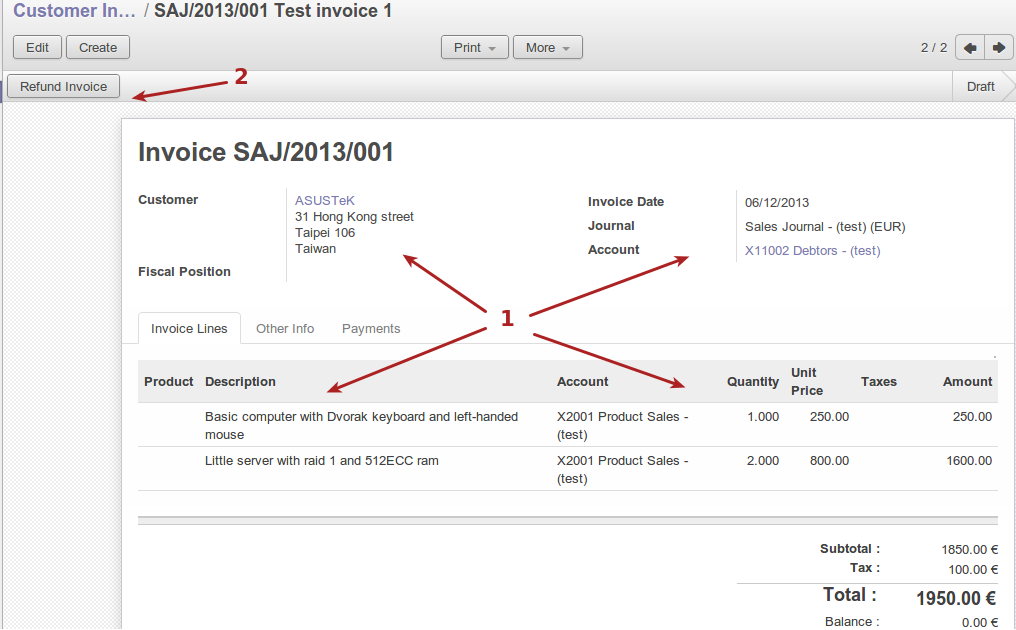

The following screen-shot displays an open invoice (once clicked on from list view) :

Various info about the invoice, including customer details, accounting details, product details.

Refund invoice button to refund the invoice if needed.

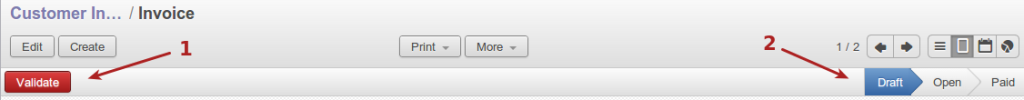

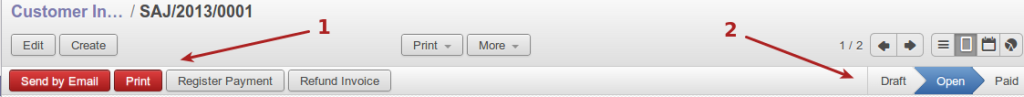

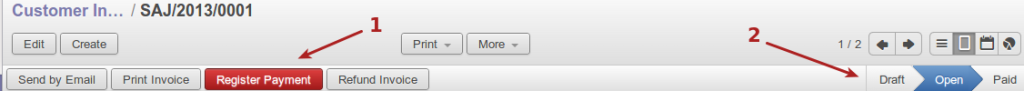

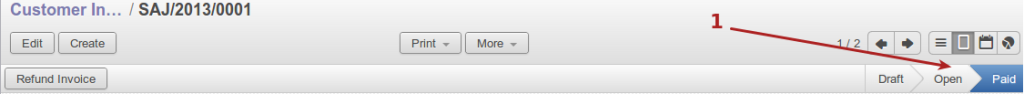

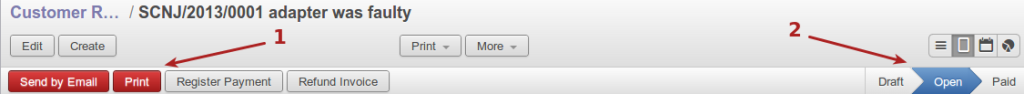

The following screen-shots display the invoice work-flow and buttons to move them along the work-flow as the processes take place :

Validate a saved invoice.

State draft until validated.

Print or send an invoice by email to customer.

State open when validated but unpaid.

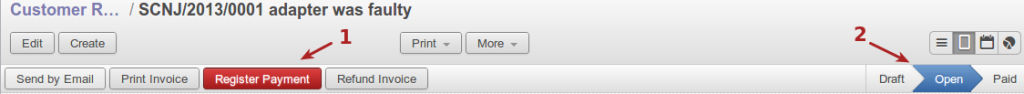

Register payment on the invoice.

State open.

-

State paid after payment registered against invoice.

Customer refunds

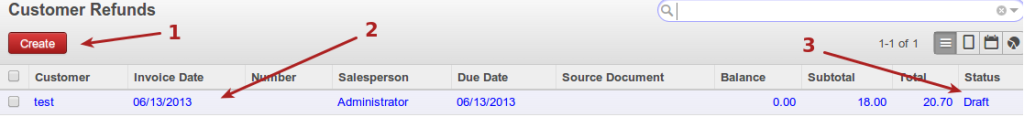

The following screen-shot displays the list view for customer refunds :

Create a new refund button.

List of refunds with refund info including customer, invoice date, etc.

Refund status, draft or reconciled etc.

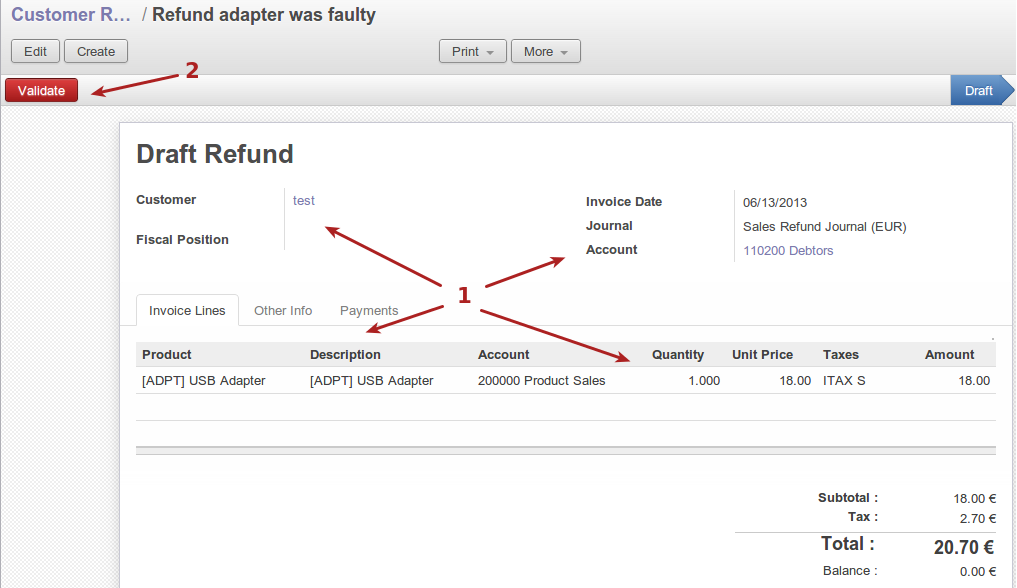

The following screen-shot displays an open refund (once clicked on from list view) :

Various info about the refund, including customer, accounting details, product details.

Validate refund button.

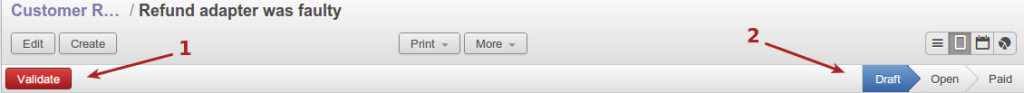

The following screen-shots display the refund workflow and buttons to move them along the workflow as the processes take place :

Validate refund button.

State draft until validated.

Print refund or send refund by email to customer.

State open while unreconciled.

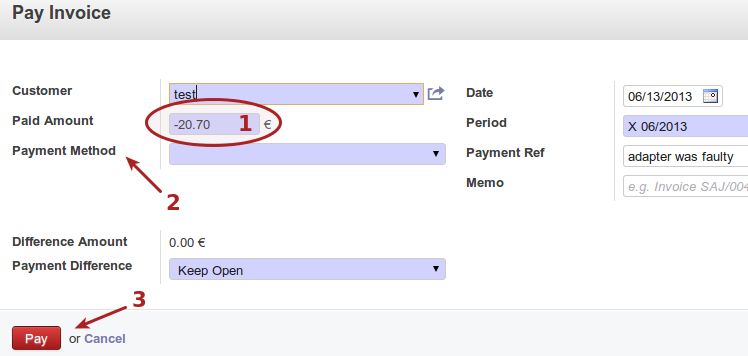

Register payment (negative payment) for refund.

State open while un-reconciled.

Registering “payment” against refund, which can be seen as a negative payment on the relevant account.

Payment method, can be cash, bank, cash journal, bank journal, etc.

“Pay” or reconcile the refund.

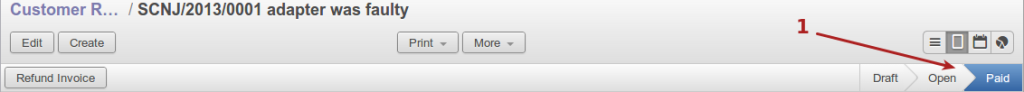

- “Paid” refund, meaning that it is reconciled.

Note : Please refer the next blog post for topics on Sales receipts & Customer Payments.